Why AI Agent Payments is the Next Big Category

The recent announcement by Stripe to create a payment SDK for AI agents joins similar moves by Coinbase, Circle, and soon OpenAI and Perplexity, signaling a growing wave of interest in combining AI agents with payments. Fintechs, AI and crypto firms alike are diving into this space, betting that agents and payments could become a major category. But what exactly are agent payments, and why would agents need the ability to pay? And what challenges stand in the way of realizing this vision?

This blog post breaks it down for you.

A Brief History of AI Agents

In October 2022, LangChain was launched as a framework to integrate LLMs like GPT-3.5 into applications. It was the first to combine LLMs into "agents"—software systems with control flows guided by LLMs, making them "agentic" and non-deterministic. Agents can take tasks, reason through them, break them into smaller subtasks, and execute them. They can also supervise their own work to ensure quality standards are met, in agentic feedback loops. Agents can also collaborate with other agents, combining their capabilities to handle more complex workflows. A notable example is Microsoft’s AutoGen framework, which made waves upon its release by enabling agents to interact and work together in innovative ways. These agents can use their discretion (via a tool-picking strategy) to interact with external tools like APIs, data sources, or even other agents.

LangChain quickly gained traction, attracting hundreds of developers on GitHub and securing significant funding in early 2023. This sparked a space race among agentic frameworks, with players like CrewAI, OpenAI's Swarm, Llama Agents, and more competing to become the standard for agent builders. While LangChain's LangGraph has taken a strong lead, the race is far from over.

By 2024, we began to see agents enter production environments for the first time, mostly in customer support and coding—low-hanging fruit for early use cases. The biggest challenge for developers has been keeping agents "on rails," ensuring they perform reliably and as intended. These challenges are rapidly solved, as tools like LangSmith are addressing these challenges, making debugging and tracing easier.

The broader vision for agents is transformative, where the holy grail is that every piece of software in the future will be somehow agentic, replacing much of today’s software. Instead of browsing the internet manually, you’ll rely on an agent to fetch only what you need and to present to you it in custom way (agents can write code and customize any website on the fly). Your daily work might involve dozens of agents—one for managing marketing campaigns, another for analyzing competitors, and others for routine tasks like scheduling or data analysis. An agent can plan your kid’s birthday party by creating a detailed schedule, setting a budget, booking the necessary vendors, and purchasing all the required supplies—handling everything from decorations to the cake. The examples are endless, but they all point to one thing: agents will soon be integral to every facet of work and life. And to fully realize this potential, agents need the ability to pay autonomously.

The agent revolution is transformational to every aspect of human society—enterprises, consumer apps, healthcare, pretty much everywhere the software exist today. Some agents will work for minutes, costing mere cents, while others might operate autonomously for weeks to complete complex projects. This level of autonomy was unimaginable until now, and agents will eventually live and operate anywhere that previous deterministic software lived.

Agents and Payments

A natural evolution of autonomous agents is enabling them to handle payments to complete their tasks. We categorize agent payments into two main types:

Last-mile payments: where the payment is the end-goal by itself. These involve consumer purchases, such as an agent buying items from an e-commerce website or procuring supplies for an enterprise.

Example: A personal shopping agent that autonomously compares prices, selects the best options, and makes purchases for you.

Resource payments: where purchasing is a step in a process to complete an end goal. Agents often need resources during runtime to complete tasks—purchasing APIs, accessing data sources, collaborating with other agents, or even hiring human services for tasks beyond machine capabilities.

Examples:

A research agent paying for premium data from APIs or hiring a human freelancer to summarize a niche topic.

A marketing agent tasked with launching an ad campaign hires a design agent to create visuals and a copywriting agent to craft compelling ad text. The marketing agent coordinates the work, ensuring the final deliverables align with the campaign strategy.

A travel agent planning a complex international trip delegates subtasks to other agents—one to find and book the best flight options, another to reserve accommodations, and a third to arrange local tours or car rentals. The travel agent aggregates the outputs into a cohesive itinerary.

While it seems obvious that agents will need to transact somehow (and dozens of agents marketplaces are being built as we speak), it is currently unclear exactly how it will be done. When we double click on the different ways payments can be done here, we encounter significant challenges that will require some serious thinking.

Each of these two payment categories present its own set of challenges, and might eventually use different infrastructure to operate on. But they both have much similarity in the pain points and challenges that are needed to be solved.

Challenges of Agent Payments

we classify the challenges for agent payments into two families - the first revolves around compliance and legal issues and the second around technical issues with current financial infrastructure.

Technical challenges:

Lack of API Interface for Payments: Currently, there is no straightforward way to make payments via an API call. Virtual cards, while promising, don’t address this gap. Virtual card APIs enable the issuance and management of virtual cards but still rely on manual entry of card details (e.g., card number, expiration date, CVV) into a merchant's payment interface. Payment systems are fundamentally designed around human-centric interactions, not programmatic execution.

The only workaround today involves unreliable and legally ambiguous methods, such as automating GUI interactions through scraping or headless browsers. This approach is not only technically fragile but also often violates the terms of service of merchants, making it an impractical and risky solution for agent-driven payments. This is both a technical challenge of reliability and compliance challenge.

CAPTCHAs and Anti-Bot Measures: Many websites employ CAPTCHAs, honeypots, and sophisticated anti-bot systems to prevent automated interactions. These mechanisms make it difficult for agents or scripts to complete transactions, often requiring human intervention to bypass them. Cloudflare and others are already taking more steps to make it harder for agents to scrap websites (this is a struggle as old as the internet), which will result in more technical hurdles for agents to just use GUIs pirately.

Fraud Detection Systems: Automated transactions are frequently flagged as suspicious by fraud prevention algorithms. This can lead to payments being declined, accounts being locked, or even permanent bans from platforms, creating significant hurdles for programmatic payments. These systems are designed to prioritize security but often disrupt legitimate automation efforts. This becomes especially painful with agents that will require many micro-services and small tasks, and will create new types of spending patterns that credit card companies are not familiar with, which will result in more blocks.

High costs: Stripe’s fixed transaction fee of $0.35 per payment, combined with a 2.7% variable fee, makes current payment systems economically unviable for the agent economy, especially for microtransactions. If an agent needs to pay $0.5 to consume the services of another agents, the $0.35 flat fee alone far almost doubles the price-per-call. This fee structure creates a significant barrier to scaling low-value, high-frequency transactions that agents rely on. There are attempts of solving this via aggregation of agent-calls, which will be feasible only when there is some centralized party managing all the agent interactions across the board, which will be unlikely because of the fragmentation of these services.

To summarize: Anti-bot measures and fraud detection systems are making automation of commercial interactions deliberately difficult. High costs further decrease practicality, limiting potential use cases for the agent economy.

Compliance related challenges:

Human-centric payment systems: Like mentioned above, the existing financial infrastructure was designed for humans. Every e-commerce or self-serve API purchase goes through a GUI which was designed for a human. It means that every person is manually accepting the purchase in the point-of-sale, which includes signing terms and conditions and going through some commercial agreement process. Automating these flows are usually against the website's terms of service, plus poses a challenge on the liability and cases of disputes (imagine the agent buying something you didn’t want, or a website with unclear commercial terms ‘tricking’ agents into buying things).

PCI compliance: Credit cards are designed for human use, with systems relying on manual processes like entering card numbers and CVVs through GUI dashboards. PCI DSS and other industry regulations strictly govern the handling of card data, requiring robust security measures, encrypted storage and transmission, and regular compliance assessments, which impose significant technical and procedural barriers to automation. This mean that developers can’t just pirately take a credit card number and save it within the agentic software, as they enter a strict compliance regime, which might end up in violating credit card companies terms and blocking the card.

To summarize: Payment systems are human-centric from the legal perspective as well, which encapsulate commercial processes which were developed over decades. It is unclear how agent automation fits this. Virtual cards and APIs don’t address this as they don’t have API based payments, and strict PCI DSS compliance adds significant technical and regulatory hurdles for developers.

How can these Challenges be Solved?

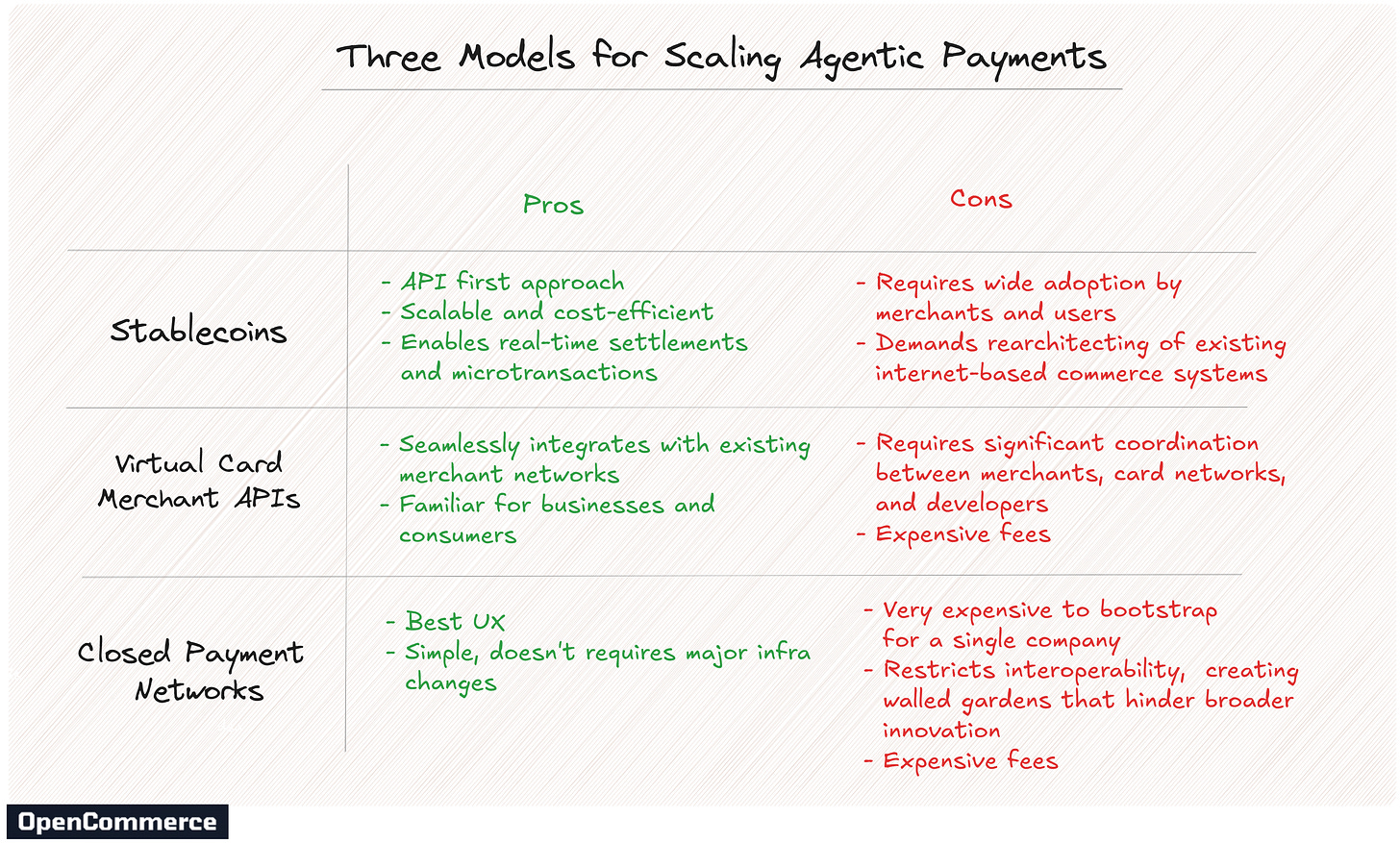

There are three approaches we can think of that can address the above challenges and enable the agent economy to flourish. Each comes with its own pros and cons, and we speculate that the future, at least for the next decade, will be some hybrid approach of all three.

First Option :Stablecoins rails

With Stripe's recent $1.1B acquisition of Bridge and advancements in legislation, stablecoins are clearly on the rise. They provide a global, programmable payment layer that aligns seamlessly with the needs of autonomous agents. A developer can spin up a stablecoin account in under 60 seconds—either non-custodial, where the agent itself manages the funds, or custodial, relying on a centralized party like a "stablecoin bank." From there, they can send U.S. dollars anywhere in the world at internet speed, for a fraction of a cent.

Stablecoins almost feel like they were invented for this purpose. They are borderless, instant, and natively support API-based transactions.

The Challenges

Stablecoins require rethinking the existing financial infrastructure to integrate them. Today, very few businesses accept stablecoins, and merchant interfaces for agent-driven payments are virtually nonexistent. Beyond adoption, there are key challenges to address:

Lack of Standardization of Merchant Interfaces and Processes: One major challenge for stablecoin adoption is the lack of standardization in how merchants accept payments. This gap spans both technical and procedural aspects:

Technical Interfaces: What constitutes a payment confirmation? How is a receipt generated and shared?

Dispute Resolution: What happens when transactions are contested? Is there a standard protocol for resolving disputes?

Terms and Conditions: Where and how do agents "sign" or agree to terms

Identity and Compliance: Businesses are understandably hesitant to accept "internet cash" from unknown sources. Robust identity verification and compliance layers are critical.

For stablecoins to gain mainstream adoption, merchants need consistent frameworks for handling payments, ensuring trust and accountability on both sides of the transaction.

Despite these hurdles, stablecoins are the only viable option for enabling microtransactions and real-time settlements at scale. Their global nature and efficiency make them uniquely positioned to become the backbone of agent-driven payments. While it will take time for businesses to adopt and supporting solutions to mature, we believe stablecoins are the ultimate solution that will win out in the long term.

Second Option: Merchants Interfaces to Handle Virtual Card Payments via API calls

The supply-side endpoint (e.g., the API or merchant offering a service) can be, at least on theory, designed to accept payment details programmatically. This requires the merchant API to support virtual card details (e.g., card number, CVV, expiration date) as part of the payment request, and the virtual card provider to be able to send the details programmatically. This is not really possible today for both technical reasons and compliance reasons that were mentioned above. On theory, we can use different technical ‘tricks’ to close the technical gaps (like using scrappers and headless browsers), and if there will be a legal shift, this might be used as an interim solution.

This approach has the advantage of leveraging existing credit card systems, but it also comes with significant challenges:

Supply-Side Overhaul: Implementing this solution requires merchants to redesign their interfaces to handle programmatic payment flows. So they will need to lower the bar for anti-bot protection, and make sure that T&C apply on cases of programmatic purchases.

Credit card companies will also need to adapt. Accepting programmatic payment flows through virtual card APIs or similar solutions will need their blessing, which probably comes with a major headache for them. Unclear if the current size of the agent economy is worthy of their time to rearchitect their entire policies.

Regulatory Ambiguity: Automating credit card payments, even via virtual cards, treads into a regulatory grey area (because of PCI compliance). There might be some potential workaround involves generating a token representing the virtual card details. The API request for the payment would then use this token rather than the card details directly. This approach could improve security and compliance, but it still requires significant coordination between vendors and standard-setting bodies.

Cost Structure: The cost remains aligned with traditional card networks, which is prohibitively high for microtransactions. While aggregation through payment gateways could reduce costs for higher transaction volumes, it doesn't address the core issue of expensive fees for individual micropayments. This limitation poses a fundamental challenge to scaling such a system in the agent economy.

Third Option: Payment Networks

Another approach is to create closed-garden payment networks. For example, Preplexity could partner with a flight booking website, integrating the entire payment process internally. This allows Preplexity users to make purchases directly within the Preplexity interface, essentially transforming the GUI of the booking site into a seamless extension of Preplexity. Users could click a button to complete a purchase, and in time, this could even extend to agents autonomously making payments from Preplexity.

This model could expand further. Preplexity could establish closed payment networks enabling a "buying agent" that interacts with a wide array of merchants, automating purchases across multiple platforms. We suspect this is already part of Preplexity’s roadmap—and perhaps OpenAI’s as well—aiming to create a major network effect by controlling both the user experience and the payment infrastructure.

While this approach is undeniably cool, even with the vast resources of companies like Preplexity and OpenAI, scaling such a network to cover the broader economy seems implausible. The challenge lies in onboarding merchants at scale, maintaining interoperability, and ensuring compliance across a fragmented ecosystem.

More critically, closed networks create significant barriers for other players. By tightly controlling the payment and transaction processes, they effectively lock out competitors and smaller developers from building their own paying agents. This stifles innovation and limits the potential of the broader agent economy. No vendor wants to be locked into a single payment option—it’s bad for business. Imagine a coffee shop with a terminal that only accepts American Express. Every customer with a Visa, Mastercard, or cash walks away. It’s a clear bottleneck, limiting potential sales to a narrow group. Businesses thrive on accessibility, not restrictions, and no vendor would willingly choose an exclusive arrangement that turns away customers at the door.

While closed-garden payment networks might offer a convenient consumer solution for companies like Preplexity or OpenAI, they’re unlikely to become the foundation of the agent economy.

Summary

We can finally say it out loud—Agent Payments is the new category in town. With more tools emerging, the future of agents and payments looks incredibly promising. But there’s still a lot to build.

In this blog post, we explored some of the challenges standing in the way, both from compliance and technical perspectives. We outlined how do we think solutions will look like, each with trade-offs around adoption hurdles, infrastructure costs, and interoperability. We’re confident this is just the beginning of a new billion-dollar industry.

At OpenCommerce, we’re building the financial stack for AI agents. If you have questions, ideas, or feedback, feel free to reach out to us:

ayal@opencommerce.xyz

idan@opencommerce.xyz