The Road to Autonomous Payments

What are the steps needed to go from manual to autonomous payments and how do we get there?

In our previous post, we outlined how do we view the agents payments space evolving and the challenges it faces. Here's a quick recap: we see two primary payment domains emerging for agents -

Last-mile payments - Where the payment itself is the agent’s end goal (e.g., a shopping agent making a purchase independently).

Resources payments - These involve paying for resources the agent requires to achieve its goals, such as hiring another agent to perform a subtask like data extraction.

We also highlighted the technical and compliance challenges involved in creating fully autonomous payment systems, challenges such as PCI DSS compliance, the lack of appropriate API infrastructure to execute financial transactions autonomously with existing merchants, and the high costs of existing card networks.

While many agree that agents and payments are bound to converge, we’re often asked a different question: How do we get there? And what are the steps needed to bridge this gap?

This blog post dives deeper into how we see this future unfolding.

Getting to autonomy is a spectrum

Just like autonomous driving cars—or any other mission-critical systems—nothing transitions from fully manual to fully autonomous overnight. The shift may seem immediate in retrospect, but it is usually gradual and requires incremental steps. These steps typically combine engineering efforts needed to enable autonomy, alongside with product and business strategies that ensure a sustainable business model to finance progress along the way.

Example: Tesla going from Autopilot to full autonomy

Tesla didn’t start with fully autonomous cars. Instead, it began by selling electric vehicles with advanced driver-assistance features such as autopilot. These systems relied on embedded infrastructure like cameras, sensors, and software that were foundational for autonomy but initially required significant human oversight.

Over time, Tesla gradually introduced updates and new functionalities, moving toward higher levels of autonomy. This incremental approach not only advanced the technology but also ensured a revenue stream by selling cars with autonomy-enabling hardware from day one, long before the software reached full self-driving capabilities. This strategy balanced technical innovation with a viable business model, enabling Tesla to fund its vision while delivering value to customers at each stage.

Payments are also mission-critical, though not to the same extent as autonomous vehicles or a Mars mission. While the stakes aren’t life-threatening, mistakes—like being charged a significant amount by error —are still unacceptable to users and can quickly lose their trust in this systems.

These are good news, as payments don’t require the decade-long timelines or extreme precision of a Mars mission or self-driving car systems. This means we can achieve reliable, autonomous payment systems in just a few years with focused effort and the right balance of engineering and user safeguards.

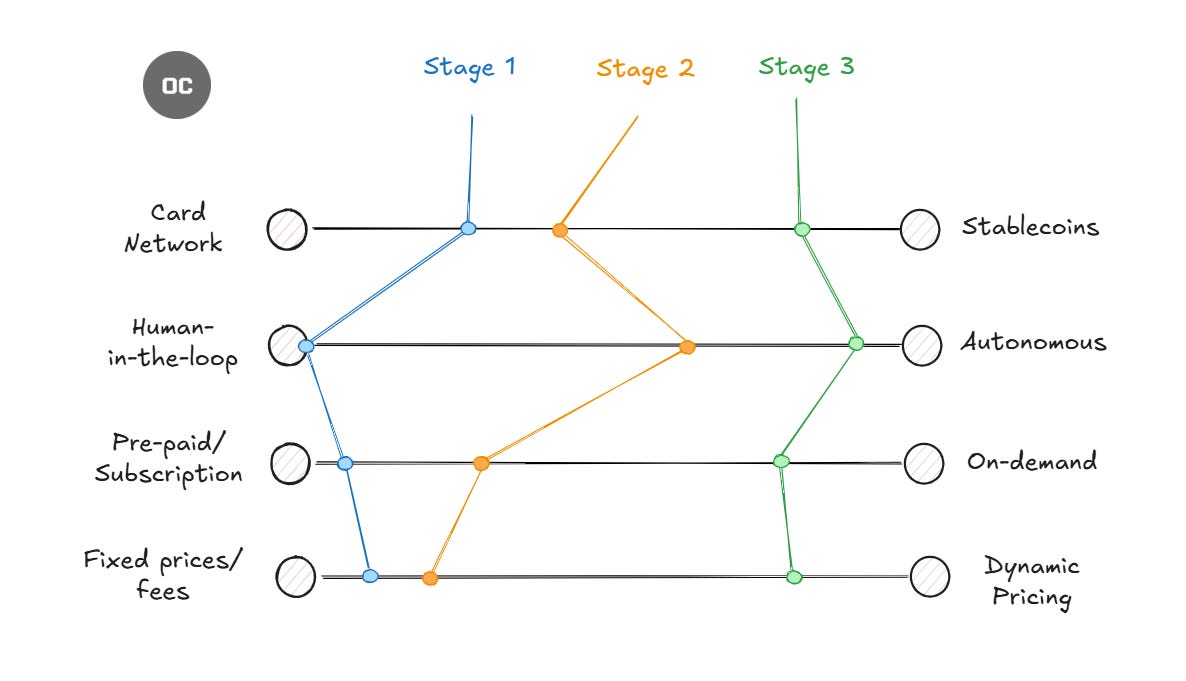

Just like the evolution of autonomous vehicles going from manual to autonomous, we’ve mapped the stages we believe will take us from where we are (manual payments, Stage 0) to fully autonomous payments (Stage 3).

These are the stages for autonomous payments:

Stage 0: Fully manual, non-programmable

Stage 1: Human-in-the-loop

Stage 2: Conditional autonomy

Stage 3: Full autonomy with oversight

Stage 4: Full autonomy with full trust (out-of-scope for now)

Stage 1: Human-in-the-loop payments

Description: Agents can initiate payment suggestions but require explicit human approval to execute transactions.

Features:

Agents prepare all payment details and present them to the user.

Users review, modify if necessary, and authorize each payment.

Note that in most cases today, agents cannot independently navigate GUIs or use them, and programmable APIs for payments are generally unavailable (we wrote about it here). So existing agents can usually only point you toward a payment link, which the user will have to use by himself. Human-in-the-loop payments might exist today in closed payment networks like the one Perplexity is building, or in B2B closed marketplaces (sometimes used for Enterprise procurement).

Here is an example of how it can look like:

Stage 2: Conditional autonomy

Description: Agents are granted autonomy to execute payments within predefined policies set by the user or organization.

Features:

Pre-set spending limits, approved vendors, and transaction types.

Agents can make payments autonomously if they fall within these guidelines.

Here is an example of how it can look like:

In this example, a planner agent tasked with organizing a birthday party featuring a Spider-Man theme. It operates within a defined budget, autonomously purchasing items as needed. For expenses exceeding a set threshold, it requests human approval.

Another scenario is a travel agent—imagine needing a flight from Tel Aviv to NYC on a specific date, during the day, and under some budget. The agent can scan the internet and automatically snipe the ticket for you once it finds a match. This highlights a growing advantage of agent autonomy: dynamic pricing. Instead of a human constantly refreshing for updates, the agent monitors price changes and acts the moment conditions are met.

Stage 3: Full Autonomy with oversight

Description: Agents have full autonomy to execute payments but operate under continuous monitoring and audit mechanisms. The difference between the policies of conditional autonomy and oversight is the level of granularity between policies and oversight. Policies are highly granular (e.g., “don’t buy by yourself anything over $20”) with oversight is general (e.g., “check with me if there is something unusual or if you’re not sure, but generally buy with your your discretion under a budget of X).

Features:

High-level or general policies that are not tightly defined (e.g. daily budget).

Users can audit transactions and set high-level policies.

Requires very high degree of trust.

Here is a (somehow) futuristic example, which might not be that futuristic in a timeline of 3 years from now:

This example showcases a sophisticated AGI marketing agent autonomously managing campaigns. It tracks mission progress, processes payments, and optimizes tasks in real time. The mission status panel displays progress and completion updates, while the activity feed logs actions like budget allocation, competitor analysis, and content scheduling.

Stage 4: Full Autonomy with Full Trust (out-of-scope)

Description: Agents operate with complete independence and are fully trusted to execute any payments without human oversight or predefined constraints, autonomously managing all financial decisions. We created this stage to leave room for the far, down the road, exciting future that can exist in a decade from now.

Shifting to new infrastructure and business models

Moving payments from stage 0 (fully manual) to stage 3 (full autonomy with oversight) requires more than just building smarter agents. The entire payment infrastructure and business models needs to evolve to handle the growing complexity and demands of autonomous systems. This will include things like moving from card networks to stablecoins (a different infrastructure stack), but also shifting from fixed to dynamic pricing (new business models). More on this in our next blog post.

Thinking in stages

In this post, we wanted to emphasize that the journey from manual payments to fully autonomous payments won’t happen overnight. The world tend to move in a more incremental way. For payments to move from stage 0 to stage 3, we will need to move incrementally in small steps, and accompany them in valuable business cases that can grow along these stages, just like the Tesla car evolved toward autonomy. Each step will open new use cases and will teach us more about the full potential of agents and payments. Right now, we’re moving from stage 0 to stage 1, a shift we estimate will take 1–3 years and will unlock massive consumer value. We’re excited to be at the forefront of it.

At OpenCommerce, we’re building the financial stack for AI agents. If you have questions, ideas, or feedback, feel free to reach out to us:

ayal@opencommerce.xyz

idan@opencommerce.xyz