The Agentic Commerce Arbitrage

New AI platforms, new CAC economics

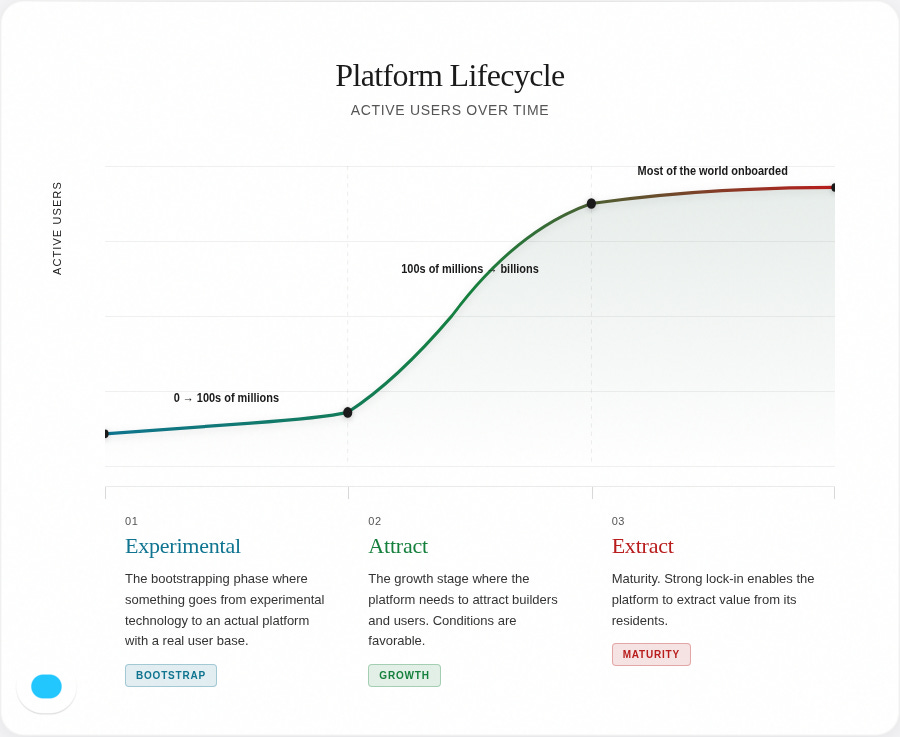

Historically, technological platform shifts tend to follow a pattern:

Experimental - the bootstrapping phase where something goes from experimental technology to an actual platform with a real user base.

Attract - the growth stage where the platform needs to attract builders and users on top of it. Conditions are favorable.

Extract - maturity. Strong lock-in enables the platform to extract value from its residents.

Social media was one of those waves, and it had a massive impact on creating the e-commerce industry as we know it today.

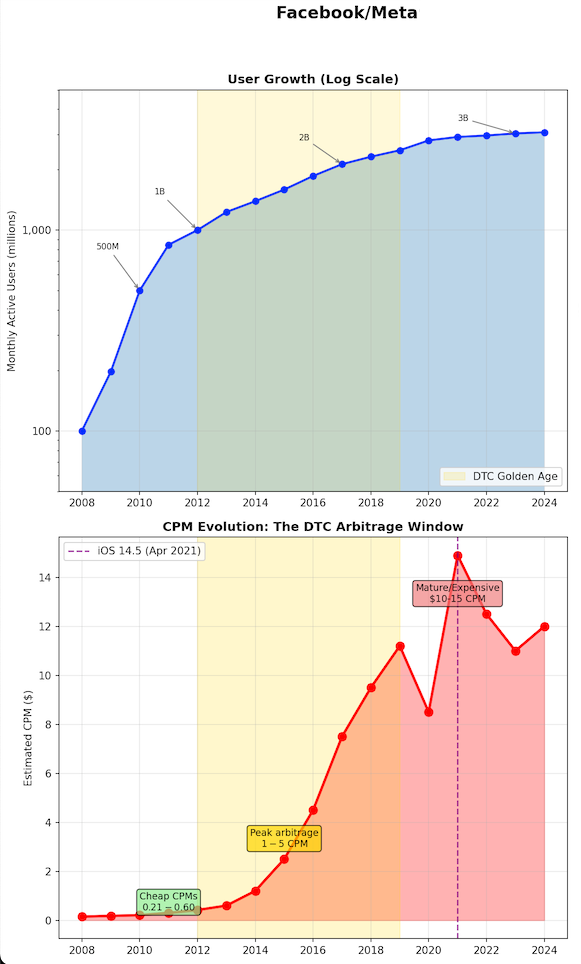

Take Facebook: they hit 1 billion users in 2012 and scaled to ~2.5 billion by 2019. These were the years of building the ads and targeting business. CPM (cost per 1,000 impressions - a proxy for customer acquisition costs) climbed from less than a dollar to around $12 today (with $15 at the peak).

2012-2019 were incredible years to build an e-commerce business because you had platform arbitrage. Facebook was in the attract phase, meaning they needed to bring users and ad demand onto the platform. Pricing was favorable (This was generally true for other platforms as well, not just Facebook).

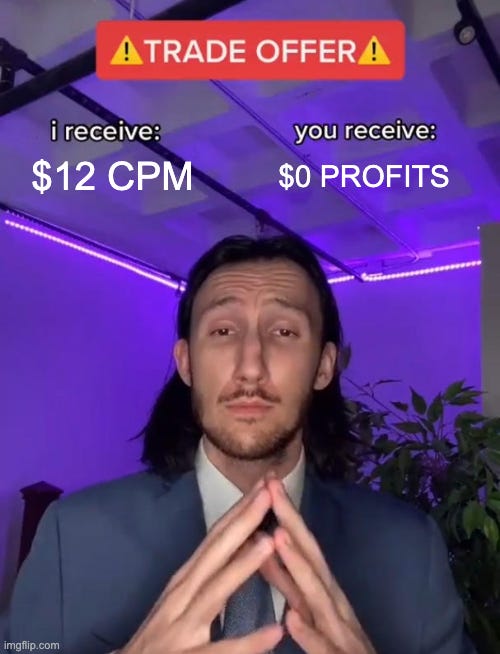

From around 2020-21 until today, we’ve been in extraction mode. Platforms are sucking the surplus profits from the e-commerce industry. This includes rising Customer Acquisition Costs (“CAC”) for ads, plus aggregators like Amazon, whose take rate grew from 30% (expensive but somehow manageable) to nearly 50% today. That leaves very little margin for brands and merchants.

This pushes the e-commerce industry to search for new channels, and to try more aggressive tactics that negatively effect profitability (e.g. ‘try before you buy’ that became a popular trend).

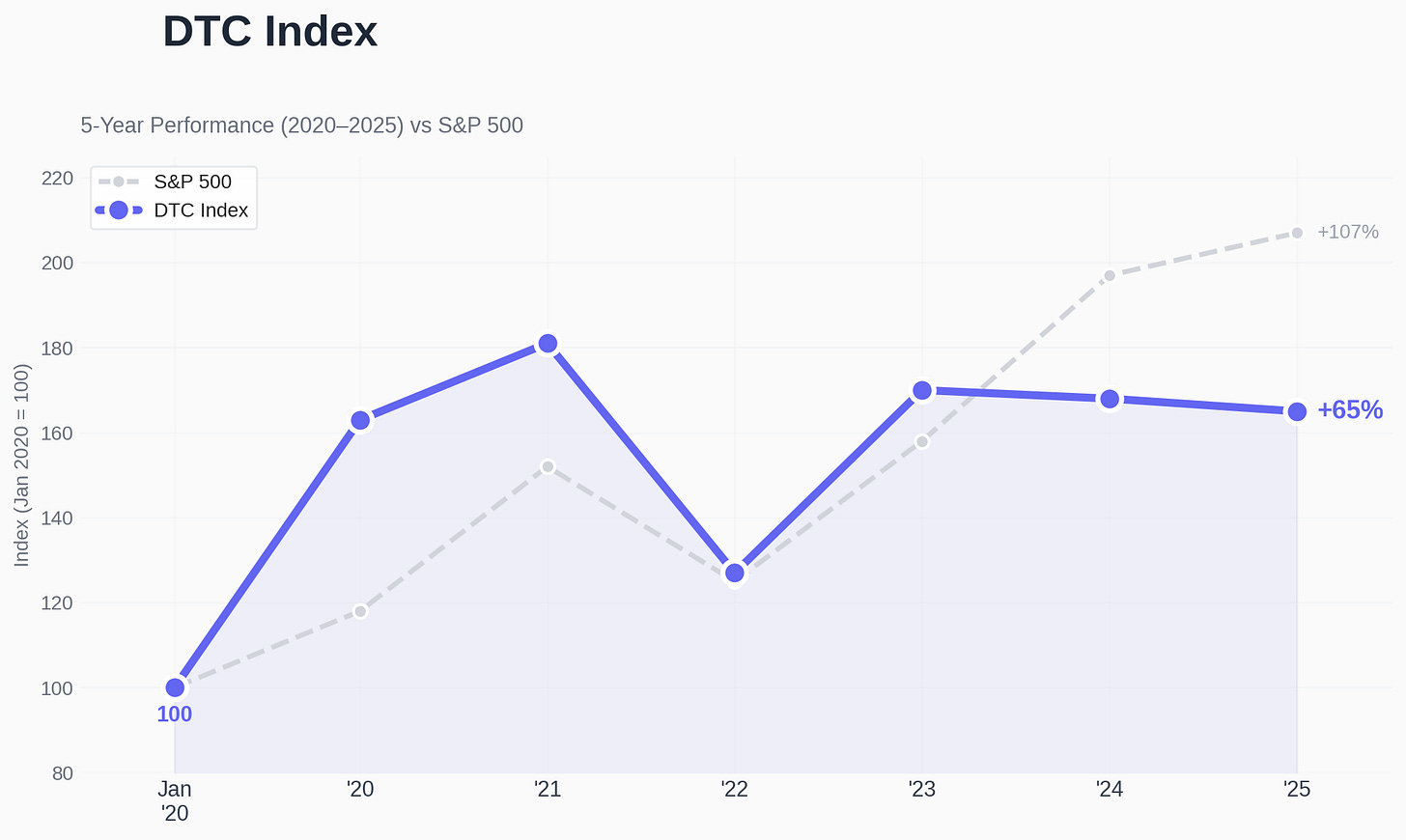

As as a result, D2C brands and their stock prices lagged behind the S&P500 for the past few 5 years (obviously there are other effects as well such as tariffs and global supply chains). Rising customer acquisition costs are heard constantly from merchant as one of the biggest challenges.

And Then Came ChatGPT...

2022-2024 can be thought of as the experimental phase for ChatGPT as a platform. The technology matured from research to productization, and they built an initial user base. As of today, they’ve reached 900M MAU - similar to where Facebook was in 2012.

OpenAI is leaning heavily into consumer, wanting to be the personal agent for every person on earth. For that, they need consumer experiences: apps, commerce, services. Unlike the current “vibe coding” discourse that takes over X, most people don’t care about coding agents, reasoning benchmarks, and AGI timelines. They mostly want to shop, hang out, and connect.

This brings us to what we think is the next phase: ChatGPT building out the consumer platform and entering the attract stage.

Connecting the Dots: The Agentic Commerce Protocol

In late October, OpenAI announced the ACP protocol to power instant checkout and ChatGPT apps. The app store for ChatGPT Apps launched just two weeks ago. To build out the platform and capture e-commerce and digital services revenue, ChatGPT needs apps and merchants to monetize on top.

This requires heavy lifting from merchants: building apps, optimizing catalogs, creating dedicated services like agentic checkout. And there are real risks - particularly losing the customer relationship when ChatGPT’s interface abstracts you away (we’ve written about this before).

Just like the cheap CPM era for Facebook, ChatGPT needs to attract merchants and convince them to build on the platform. The alternative is that Gemini, Anthropic, Meta, Grok, or someone else builds out the consumer AI platform instead.

That explains the attractive conditions we’re seeing with instant checkout - merchant remains merchant of record, and rumors of a mild 2% fee.

Extrapolating this into the future, we think that the next few years might be the ‘low CAC period’ for AI consumer platforms.

For How Long?

Things are moving fast in AI land, much faster than previous platform shifts. But platform building still takes years - a big portion of the constraint isn’t technical, it’s consumer behavior change, and that takes time.

This means merchants probably have years to capitalize on this “CAC arbitrage” and build out their AI agent distribution.

On the last platform wave, we saw tons of brands and merchants build themselves up from nothing. Warby Parker, Dollar Shave Club, Allbirds, Casper and hundreds of other brands proved you could build $100M+ sales companies going direct. AI platforms might reopen that opportunity.

If you want to get more in-depth analysis on the latest trends in agentic commerce, subscribe below.

And if you’re a merchant and want to get ready to sell on ChatGPT, nekuda offers enterprise-grade ACP to sell on AI platforms. Contact us for further details here:

founders@nekuda.ai

I skimmed through some of articles in your Substack and started follow along. I like the way you simplify the tech topic to much consumer friendly. I am also writing on this topic but from PM perspective.