Everything you wanted to know about ChatGPT Checkout and ACP Protocol

The Genesis of Agentic Commerce

We view the Agentic Commerce Protocol (ACP) which was announced yesterday as the formal starting point of agentic commerce.

This is the biggest development in commerce - agentic or otherwise - in 2025 and in the last few years (or even more). Because of its importance, this post is structured backwards: we’ll start with the high-level summary and implications, then move into details. At the end, we’ll share open questions, and some more detailed technical analysis for payment geeks.

Background

Yesterday, OpenAI announced that users can now browse and buy products directly in ChatGPT. Stripe is powering payments, and the integration is based on a new open standard called Agentic Commerce Protocol (ACP) - site here.

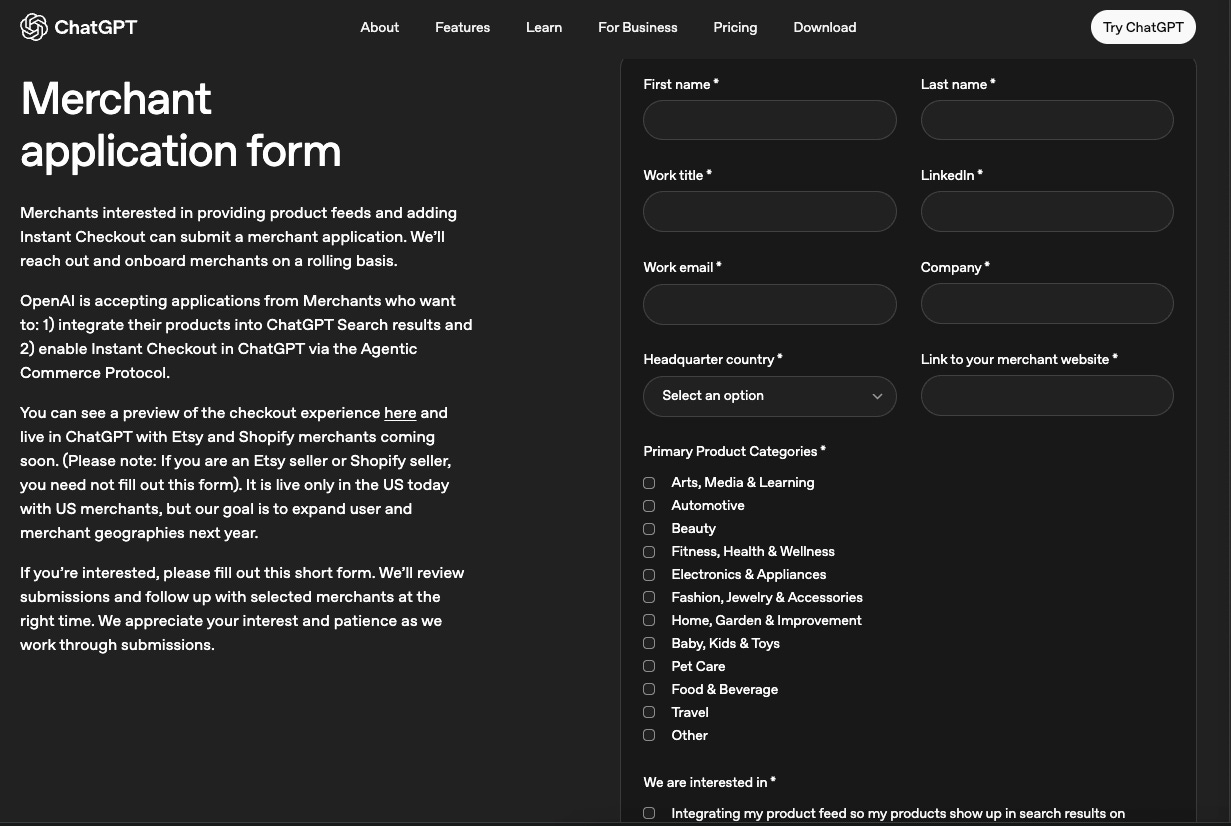

The initial rollout is with Etsy, and Shopify merchants coming soon. To participate, merchants must onboard through OpenAI and comply with ACP.

What is ACP?

At its core, ACP is an API spec for how an agent (like ChatGPT) interacts with a merchant.

Catalog Feed: Merchants expose a Product Feed (spec here). It contains their product catalog, which is how agents discover and display items. SEO/AEO specialists are already publishing guides on how merchants should optimize feeds to rank in ChatGPT results. This will become a new acquisition channel, requiring ongoing merchant investment.

Agentic Checkout: Defines how agents and merchants exchange information during checkout - cart, pricing, tax, shipping. Importantly, the merchant remains the Merchant of Record, with full responsibility for fulfillment, refunds, and compliance.

Delegated Payment: Handles secure payment between agent and merchant. Instead of sharing raw card details, the agent sends a one-time scoped token (amount, merchant, expiry). This avoids PCI scope for both the agent and the merchant.

Both checkout and delegated payment specs are open source. Any agent or merchant can implement them and be compatible with ACP. If a merchant wants to be discovered in ChatGPT, they can apply here.

Why This Is Big

Think of the 1990s and early 2000s, when telcos laid the wires for the internet, which enabled the internet we know today. We view ACP as the same foundational layer for agentic commerce.

Why? Because ChatGPT’s scale forces merchant adoption. No merchant wants to miss a channel that touches nearly a billion users. This creates a strong dynamic: within a short period, most U.S. merchants will likely adopt ACP - or risk being invisible on the fastest-growing acquisition channel.

Once they do, two things happen:

Merchants go API-first. To support ACP, they’ll need API infrastructure, which they can also expose to other agents (no actual reason to limit yourself only to ChatGPT). Other agents can be for example Gemini, or it can be small vertical agents. This will make the task of building a commerce-agent much easier and standardized (today you have to deal with browser agents and brittle integrations which are very hard to scale).

The ecosystem seeds itself. Any agent- shopping, travel, personal assistants - can reuse ACP endpoints to build new consumer experiences.

Even if ChatGPT’s checkout experience isn’t perfect, merchant adoption will be near-universal. That adoption is the real story: ACP is the infrastructure for agentic commerce.

Strategic Dynamics

Stripe’s Role

Stripe co-developed ACP and powers the payment flows for Etsy and Shopify on ChatGPT. That gives Stripe two wins:

Processor Advantage. ACP is processor-agnostic, but Stripe was the first to implement integration with ChatGPT. On top of that, ChatGPT supports Stripe Link as a payment method (Stripe’s built-in wallet).

Shared Payment Token (SPT). Stripe introduced SPTs under a new API. This is made for other agents that want to use Stripe to build commerce agents and is based on the ACP standard. Agents collect card details, store them with Stripe, and at checkout issue a scoped token to merchants (who must also be on Stripe to our best understanding). This creates a closed loop of Stripe-powered agents and merchants—a powerful play.

The obvious question is what happens when an agent developer uses the SPT API but the merchant relies on another PSP. Will other PSPs collaborate to make their tokens interoperable? If not, we risk fragmentation that will hurt UX.

What’s Missing

Visa and Mastercard’s Agentic Programs. They’ve launched support for network tokens in agentic flows, but ACP doesn’t make use of the advantages (like unique authentication or passkeys), although network tokens are referenced as one potential means of payment.

Advanced Agentic Use Cases. ACP today isn’t really “agentic.” It’s a commerce protocol for third-party apps. Features like scheduling future purchases, recurring orders, or agent-driven negotiation aren’t here yet. ACP deals with the starting layer, not the full stack.

The Big Implication

Once merchants adopt ACP for ChatGPT, they automatically become available to every other agent. No extra integration needed.

That’s the holy grail: a single open standard that consolidates the ecosystem.

Winners and Challenges

Winners:

OpenAI: adding a commerce layer, dictating the standard to the entire world.

Stripe: first mover, new agentic commerce product with closed-loop via SPT and smoother UX in ChatGPT (Stripe Link).

Merchants who adapt early: gain visibility in a new channel.

Challenges:

Competing PSPs: need to close the gap or risk losing share.

Visa/Mastercard: must understand how agentic tokens fits in.

Merchants: must maintain and optimize feeds continuously, which adds cost and complexity.

Payment Geeks Section

A big part of the ChatGPT payment flow is designed to keep the agent outside of Merchant of Record status. Here’s how it works in practice:

ChatGPT stores the buyer’s payment credentials once (card-on-file).

Each time the user wants to buy, ChatGPT sends a delegated payment payload (i.e. the card-on-file details) to the merchant’s PSP or vault. This payload is single-use and scoped with spending limits.

The PSP responds with a one-time payment token (what Stripe calls a SPT).

ChatGPT forwards that token to the merchant, and the merchant uses it to complete the charge with the PSP.

This setup keeps sensitive credentials away from agents, avoids PCI scope, and makes the merchant responsible for the actual transaction.

They also mentioned that if you’re a paid ChatGPT user, your payment details will be prefilled at checkout - likely pulled from the vault and auto-filled (This is powerful because paying for ChatGPT effectively populates your wallet automatically. The only caveat: you still need to make sure fields like shipping and billing are accurate).

Open Questions

How quickly will non-Stripe PSPs catch up with ACP’s delegated payments spec?

Will Visa and Mastercard adapt their agentic token programs to ACP?

Will agents beyond ChatGPT - Gemini, Claude, smaller vertical players - adopt ACP, or push competing standards?

Final Word

ACP is less about ChatGPT checkout and more about the infrastructure it forces into existence.

By pulling merchants into a single, open standard, ACP lays the groundwork for the entire agentic commerce ecosystem.

This is the agentic commerce genesis.

No, not everything. Just some of the things.

But that presumes you actually know what I want, which is absurd since we don't even know each other.